According to the Finance Initiative of UN Environment (UNEP-FI) the capital needed to realize the 2030 Agenda for Sustainable Development worldwide amounts to USD 5-7 trillion a year. Given the scale of capital needed, it is of vital importance to implement market mechanisms to reflect the potential benefits of sustainable investments and attract interest from potential investors. The international community has made clear that the private sector – including financial institutions – plays a fundamental role in the realization of the 2030 Agenda and the delivery of the Sustainable Development Goals (SDGs) and the Paris Agreement in

the years to come.

More than 240 banks, insurers and investors with some USD 62 trillion in assets are committed to integrating sustainability into operations as members of UNEP FI. In addition, 78% of over 22,000 investors worldwide surveyed for Schroders' 2017 Global Investor Study, claimed they now place more emphasis on sustainability than they did five years before. 64% indicated that they have increased their allocations to sustainable funds over the same period.

Within the wider field of sustainable finance, green bond markets have gained increased attention and experienced significant growth in issuance volumes over the past five years. The global market grew from USD 11.3 billion in 2013 to USD 183 billion in 2018. The dynamic growth in sustainable finance is, however, limited by a general lack of understanding of what sustainable investing is and the benefits it can achieve in comparison to traditional investments. Providing relevant stakeholders in governments, the financial sector and businesses with better information and expertise on the topic can enhance the chances of bringing sustainable finance into the mainstream.

This e-learning programme aims to speed up the transition to a sustainable economy at the national and international levels and to pave the way for wide array of sustainable finance products by raising awareness

among interested stakeholders.

This interactive and practice-oriented course covers the basics of Sustainable Finance while providing several opportunities to dive deeper. It shares valuable insights of the Strategic Alliance of GIZ and SEB and our technical partner CICERO, gained during activities in emerging economies and interactions with market participants worldwide. You will also learn about examples of UN-supported initiatives to promote sustainable finance in countries like Mongolia and Indonesia. The course is designed for interested participants from governments, financial sector, businesses, and civil society.

Download SyllabusTarget Audience

The proposed programme targets groups and individuals from the public and private sectors, and civil society interested in learning about how sustainable finance can transform the way today’s economies work.

The programme will be suitable for introductory level learners but can be also be used by learners with existing knowledge and experience related to sustainable finance. Prospective participants include:

- Government officials involved in developing and setting up policy frameworks for sustainable development and in particular sustainable finance;

- Individuals from public and private sectors and institutions that are potential issuers of or investors in sustainable finance products;

- Professionals involved or interested in underwriting, research, consultancy or other professional services for sustainable finance products;

- Other individuals/institutions with an interest in sustainable finance.

Learning Objectives

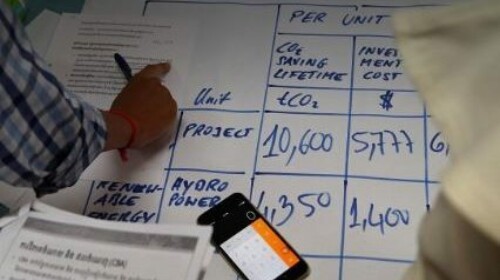

The e-learning programme provides technical knowledge on why and how to choose sustainable finance solutions over conventional investment. For that, participants will begin to acquaint themselves with basic skills and tools for applying the sustainable finance mechanisms to a real-world policy or business context.

After completing the course, participants will be able to:

- Describe, understand and discuss current developments and trends in the area of sustainable finance;

- Distinguish between different types of sustainable finance products and relevant eligibility criteria;

- Discuss opportunities, challenges, and enabling conditions for countries to benefit from growing sustainable investment opportunities;

- Identify opportunities for the public and private sectors to issue green bonds and green loans;

- Apply sustainable finance mechanisms to a real-life investment case study.